PROUDLY SERVING ISLAND CLIENTS

The Mortgage Process in today’s world is so streamlined, you don’t even have to leave the comfort of your home. That’s why The HomeHappy Team

has been proudly serving clients across BC for years.

Whether your buying a home or investment property, refinancing or seeking to consolidate debt, we’ll find a custom mortgage plan to fit your needs and guide you every step of the way through the process.

So What are the Steps?

Contact us by phone or e-mail whichever you prefer, we’ll connect and learn about you and your unique situation, no one person is the same, no single type of mortgage fits all. We’ll find you the right fit!

Remember, a great rate is important for sure…but, there are equally important aspects to mortgages to consider; we’ll provide unbiased advice and guidance to ensure you’re making a fully informed decision.

We have helped customers in Nanaimo, Victoria, Campbell River, Parksville, Courtenay and Sidney. See how we can help you today!’

LET'S CONNECT

BUYING A HOME?

Get Pre-Approved

before you go house hunting we’ll help you determine how much of a mortgage you qualify for, ensuring your looking at homes in your price range.

Find A Realtor

Once you know your price range you can begin your search, if you don’t we have several trusted partners across the province we’re happy to connect you with.

Find “The Home” ; with an Offer in and Accepted Contract subject to Financing (and other pertinent subjects ie: inspection or review of strata minutes); provide us a copy and we’ll work with the lender to get that specific property approved for your mortgage. We’ll get you connected with an appraiser to support the home’s property value (purchase price).

Documentation: send us pertinent documentation (ref our doc’s list under the More Happy tab and we’ll send you a detailed list as well), these form part of the “conditions” to be met by the lender, once we/they have them all “satisfied” you can remove subjects and have a “firm sale” and Deposit $ is due.

Conveyance Lawyer: if you don’t have one we have several trusted partners across the Province. They will arrange a time for you to meet at their offices about 3-4 days prior to completion to sign the mortgage documents and facilitate transferring the title of the new property to your name at “closing” and paying out your “old” mortgage (if applicable).

REFINANCING?

Most people refinance when they have equity in their home; (EQUITY = the difference between the amount owed on the mortgage and the value of the home). Many people refinance in order to obtain money for large purchases including home renovations, debt consolidation, buy a new car, or perhaps even as a down payment for a rental (investment) property or help their children with their down payment. For more information check out our Refinance page under “Happy Options”.

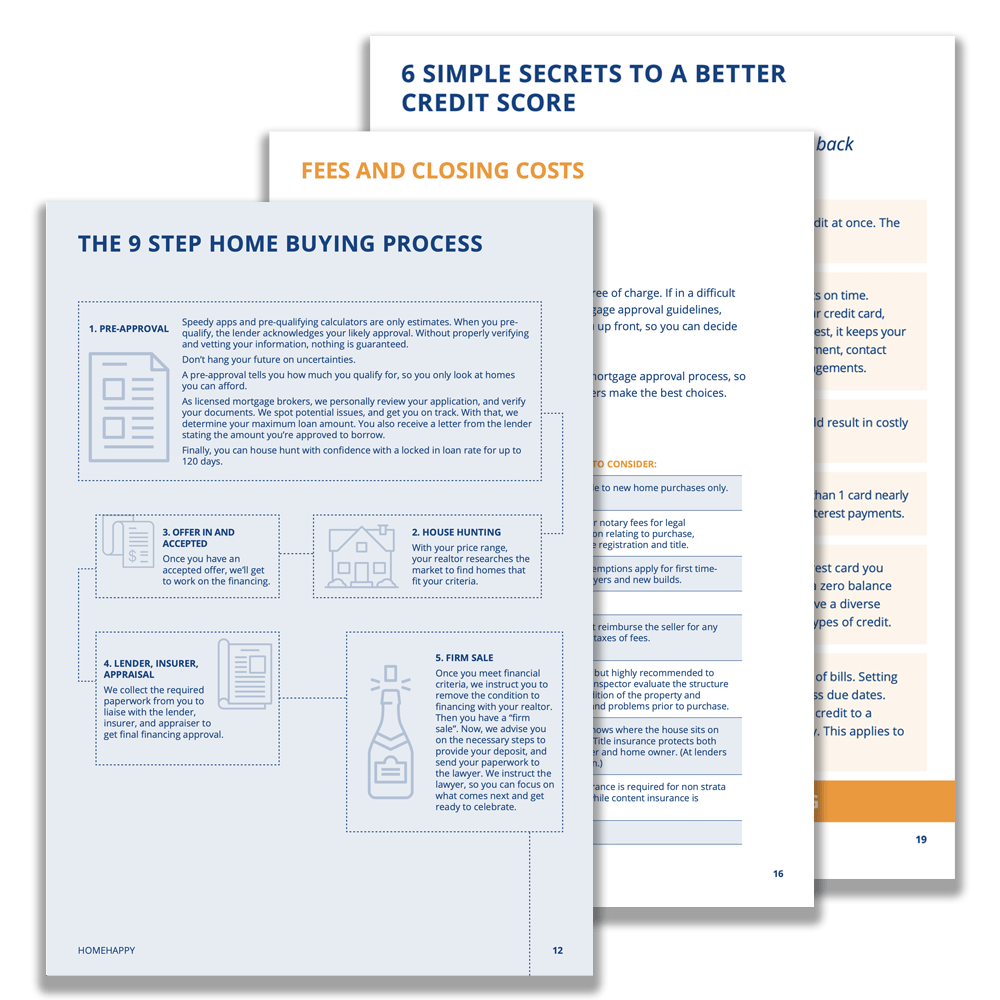

Download our Home Buyers Guide, it’s a comprehensive “how to” for Buying & Refinancing

Remember, we work for YOU not the Lender. Once we match you with the right mortgage product the lender provide us a “referral” fee… that’s how we get paid for helping you throughout the process.

GET IN TOUCH

604-833-4663 (HOME)

team@homehappy.ca

#111 6323 197 Street, Langley BC

V2Y 1K8

HomeHappy Okanagan

3954 Beachview Drive, West Kelowna, BC V4T2K1

778-363-7811

www.okmtg.ca

© Copyright 2023 | All Rights Reserved | HomeHappy