Cash When You Need It: The Perk of Building Home Equity

Investing in your future is the gift that keeps on giving. Owning property can create fantastic leverage, and give you opportunities to free up cash should you need it. When you borrow against your own investment, lenders often see you as a safer bet.

Accessing the cash you’ve invested in your home can be great for debt consolidation, and for larger purchases like home renovations, making investments, or paying for education.

Want to know more about how your home equity can work for you?

Keep reading.

What is home equity?

Home equity is the portion of your home that you actually own.

You build home equity in two ways:

- As you pay your mortgage.

- If your home’s market value increases.

Basically, it’s the difference between what you owe and your home’s current value. To calculate yours, subtract how much you still owe from the current price of your home.

For example, if your home’s worth $450,000 and you owe $300,000 on your mortgage...you have $150,000 in home equity.

How it works

Your home equity is likely your most valuable asset. It’s a great financial tool that can allow more flexibility in your financial planning. Borrowing against what you own means you have a stake in the process, and gives lenders a solid guarantee that you’ll pay back what you borrow. This often results in better rates than a personal loan.

First things first, there’s an approval process that determines whether you can borrow money against your home equity. Just because you have home equity, doesn’t mean you can use it.

Note: not all lenders offer home equity financing options, and they aren’t created equally: consult us to determine your best options available.

Refinancing your home

Borrow up to 80% of your home’s appraised value, minus your current mortgage balance and any outstanding loans secured against your home. Refinancing is replacing your current mortgage with a new product. Your lender may also agree to refinance your home with one of these options:

- A second mortgage

- A HELOC

- A loan or line of credit secured with your home.

What you can expect when refinancing:

Your refinancing terms will likely be different than your original mortgage. While refinancing typically saves you money, as with any mortgage product, there are administrative fees like: appraisal fees, title search, title insurance, and legal fees. You may also have to pay a new mortgage loan insurance premium.

Click here for

refinancing 101, and cover the basics of this complex topic.

Home Equity line of credit (HELOC)

Similar to your typical line of credit, a HELOC allows you to borrow money at your convenience, up to your credit limit. Typically you can access up to 65% of your home’s appraised value. Secured against your home, it’s a form of revolving credit: you can pay it back and borrow again. Much like your home, it’s there when you need it.

What you can expect:

With discretionary access to your home’s equity, this is an option best suited to disciplined people. You’re responsible for monthly interest only payments on your outstanding balance. There’s no penalty, so it can be a great way to finance a project without modifying your mortgage.

HELOC interest rates are variable and fluctuate with the market. There are associated administrative fees, and the terms of your original mortgage agreement may be altered.

For more details on getting a HELOC be sure to weigh the pros and cons against your needs, and consult us for expert advice.

Borrow prepaid amounts

Have you made lump-sum payments on your mortgage? Your lender might allow you to re-borrow your investestment. Whatever you re-borrow (up to the total amount of all prepayments) will be added back to your mortgage.

What you can expect:

Your mortgage rate either stays the same or you’ll pay a blended interest rate on the borrowed amount. A blended rate combines the current market rate with your mortgage interest rate.

With this option, you may not have to make any changes to your mortgage term. While you avoid many of the typical fees associated with borrowing on home equity, you should check with your lender. Fees vary, and your lender is the best source of specific information when it comes to borrowing on amounts you prepaid.

Second Mortgage

The basics are in the name -- a second mortgage is a second loan taken on your home that’s secured against your home equity. You can borrow up to 80% of your home’s appraised value, minus your remaining mortgage balance.

What you can expect:

You now have two mortgages, which means two separate payments. Both your first and second mortgages need to be paid simultaneously.

Keep in mind, you could lose your home if you can’t make both your payments. If you default on the loan, your home will be sold to mitigate the lender’s loss.

Since second mortgages are riskier for lenders, interest rates are typically higher. There are also administrative fees like appraisals, legal, title search, and title insurance to consider.

Reverse Mortgage

Access home equity without selling. A reverse mortgage allows you to borrow up to 55% of your home’s appraised value. Your borrowable limit depends on your age, your lender, and your home’s value. This option is not available to everyone. To qualify, you must be a homeowner and at least 55 years old.

What you can expect with a reverse mortgage:

You only pay back your loan when you move, sell, or the last borrower dies. You aren’t required to make payments on a reverse mortgage until the loan is due, though your interest increases the longer you don’t pay. This means you may have less home equity when your loan term ends.

A reverse mortgage has higher interest rates than a regular mortgage, and can be either fixed or variable. The typical administrative fees apply. There may also be a prepayment penalty if you pay off your reverse mortgage before it’s due.

For more information on how a reverse mortgage works, and other factors to consider consult us or

click here for more information.

Review your options

When broken down to the basics, it can seem like your options are more similar than different, but real life application is never so simple. The best way to understand your options, and what will work best for you and your family is to seek expert advice.

Not only are you likely to save more money with a trusted advisor, it’s hard to go wrong when the service is free. Have your unique needs met by using the collective might of our fantastic team. Get the best deal and do more with your best asset.

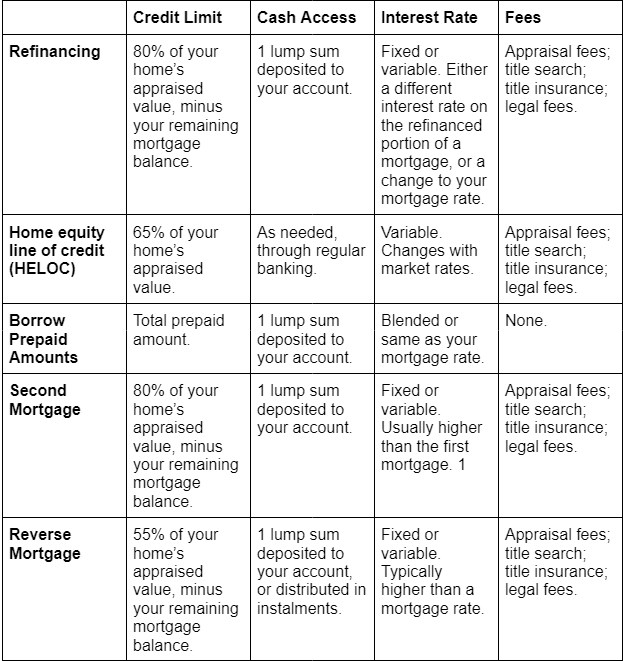

Quick reference table for comparing options to access your home equity:

Share:

Recent Posts